PM SVANidhi Scheme

The PM SVANidhi (Prime Minister Street Vendor’s AtmaNirbhar Nidhi) scheme was initiated in June 2020. It has been a beacon of hope for street vendors adversely affected by the COVID-19 pandemic. This central government scheme offers collateral-free working capital loans to approximately 50 lakh street vendors across India. It enables them to revitalize their businesses in urban areas. This guide provided the details of the PM SVANidhi Scheme, its key features, eligibility criteria, and the positive impact it has made on the lives of street vendors.

Key Facts About PM SVANidhi Scheme

| Key Information | Details |

| Scheme Name | PM SVANidhi (Prime Minister Street Vendor’s AtmaNirbhar Nidhi) |

| Launch Date | June 01, 2020 |

| Scheme Tenure | Initially valid till March 2022, extended up to December 2024 |

| Executing Ministry | Ministry of Housing and Urban Affairs (MoHUA), Government of India |

| Target Beneficiaries | Street vendors in urban areas since March 24, 2020 |

| Documents Required for Verification | Aadhaar card, Voter ID card |

| Loan Amount | Up to ₹10,000 (collateral-free) |

| Repayment Tenure | 12 months |

| Prepayment Benefit | 7% subsidy on interest for early repayment |

| Collateral-Free Loan | Yes |

| Incentive for Digital Transactions | Cashback for digital repayments |

| Interest Rate | Similar to rates by various financial entities |

| Eligibility Criteria | Based on vending certificates, LoR, and survey results |

| Implementation Partner | Small Industries Development Bank of India (SIDBI) |

| Lending Institutions | Various banks, SHGs, NBFCs, and MFIs |

| Top Performing States | Uttar Pradesh, Madhya Pradesh, Telangana, Gujarat, Andhra Pradesh |

| Digital Transaction Incentives | Cashback on digital transactions, up to ₹100 per month |

| Total Impact of the Scheme | Over 37 Lakh loans sanctioned and disbursed, impacting livelihoods positively |

| Official Website | PM SVANidhi Portal |

Objectives of the PM SVANidhi Scheme

During the COVID-19 pandemic, the scheme’s focus was to provide vital support to street vendors who were disproportionately affected by lockdowns.

- Provide economic stability to street vendors affected by the COVID-19 pandemic.

- Offer unsecured working capital loans of up to ₹10,000 to help vendors resume their businesses.

- Incentivize regular loan repayments as per the schedule.

- Reward vendors with cashback for processing payments digitally.

Features of PM SVANidhi Yojana

- Loan Amount: Unsecured loans of up to ₹10,000.

- Repayment Tenure: 12 months.

- Prepayment Benefit: 7% subsidy on interest for early repayment.

- Collateral-Free Loan: No asset collateral is required.

- Incentive for Digital Transactions: Cashback for digital repayments.

Check Out: Chhath Puja: Significance, Special Trains for Chhath Puja 2023PM SVANidhi Loan Interest Rate

- Interest rates aligned with those of Scheduled Commercial Banks, Regional Rural Banks, Small Finance Banks, SHGs, and Cooperative Banks.

- Interest rates from NBFCs and NBFC-MFIs follow RBI guidelines.

PM SVANidhi Yojana Eligibility Criteria

Eligibility Criteria for UT/States:

Scheme availability depends on State/UT issuance of a certificate via the Town Vending Committee (TVC) and compliance with the Street Vendors Act of 2014.

Eligibility Criteria for Beneficiaries:

- Must have been a street vendor before March 24, 2020.

- Possess a vending certificate/identity card from the Urban Local Body (ULB).

- If no certificate, a provisional certificate from the ULB is acceptable.

- A permanent certificate is needed within 30 days of the provisional one.

- New vendors can obtain a Letter of Recommendation (LoR) if they started their business after the TVC survey.

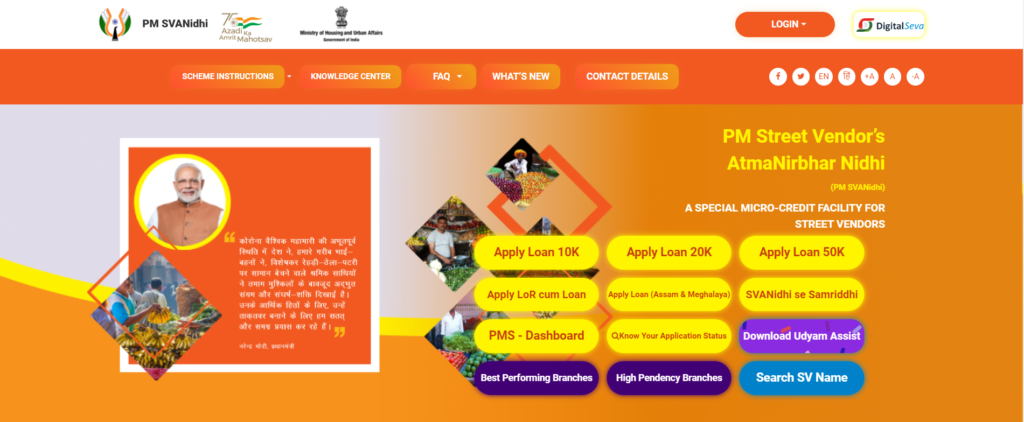

How to Apply for a Loan Under PM SVANidhi Scheme

- Visit the official PM SVANidhi website.

- Click ‘Apply Loan 10K’ and enter your mobile number and captcha.

- Request and verify the OTP sent to your mobile.

- Choose your vendor category.

- Upload required documents (Survey Reference Number and vending certificate for Category-A, LoR for Category-C/D).

- Enter and verify your Aadhaar card number using OTP.

- Accept the declaration and authorization.

- Submit the application and note down your application number for future reference.

Documents Required for PM SVANidhi Scheme

- Aadhaar Card: Your Aadhaar card is essential for identity verification and is often used as a primary document.

- Voter ID Card: Voter identification cards are also commonly accepted for verification purposes.

- Vending Certificate/Identity Card: If you are a street vendor who possesses a Certificate of Vending or Identity Card issued by your Urban Local Body (ULB), this is important to prove your vending status.

- Letter of Recommendation (LoR): In case you started your vending business after the survey conducted by the Town Vending Committee (TVC), an LoR from your concerned ULB/TVC can be a supporting document for eligibility.

- Other Documents: Depending on your specific situation or the state/UT requirements, additional documents may be requested for verification. These could include proof of past loans, evidence of availing of one-time assistance, membership details of vendor associations, and any other documents that certify your status as a legitimate street vendor.

How to Apply for a Letter of Recommendation (LoR) by Street Vendors Under PM SVANidhi

- Visit the PM SVANidhi Scheme website.

- Click ‘Apply for LoR’ and enter your mobile number to request and verify the OTP.

- Complete the LoR application form with accurate details.

- Upload documents, including proof of past loans, one-time assistance, membership in vendor associations, and any other proof of being a legitimate street vendor.

- Submit the application and note down your LoR application number.

Check Out: Pradhan Mantri Mudra Yojana (PMMY) Guide: How to Apply, Eligibility Criteria, Benefits!How to Check Your PM SVANidhi Loan Status Online

- Visit the official PM SVANidhi website.

- Click ‘Street Vendor Survey Search.’

- Fill in details, including your State, ULB name, vendor certificate/ID number, your name, your father’s/spouse’s name, and Aadhar-linked mobile number.

- Click ‘Search’ to check your survey status.

This detailed breakdown using bullet points should provide a clear and concise understanding of the PM SVANidhi scheme and its various aspects.

Top 5 Performing States of the PM SVANidhi Scheme

- Uttar Pradesh: With nearly 9.8 lakh eligible applicants and 8.73 lakh loans sanctioned, Uttar Pradesh tops the list.

- Madhya Pradesh: It has 7.41 lakh eligible applicants and 5.21 lakh sanctioned loans.

- Telangana: Over 5.36 lakh eligible applicants and 4.02 lakh loans sanctioned in Telangana.

- Gujarat: The state has 3.69 lakh eligible applicants and 2.18 lakh loans sanctioned.

- Andhra Pradesh: With 2.81 lakh eligible applicants, more than 1.98 lakh loans have been sanctioned.

Implementation Partner for PM SVANidhi

- The Ministry of Urban and Housing Affairs (MoUHA) is the nodal agency overseeing PM SVANidhi’s implementation.

- Small Industries Development Bank of India (SIDBI) collaborates with various entities to assist in implementation. These entities include Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks, Non-Banking Finance Corporations (NBFCs), Micro Finance Institutions (MFIs), and Self-Help Groups (SHGs).

Digital Transactions by Street Vendors Under PM SVANidhi Yojana

- To promote digital transactions, the scheme offers cashback incentives for transactions above ₹25 processed digitally.

- Vendors can earn cashback of up to ₹100 monthly, as shown below:

- First 50 eligible transactions: ₹50

- Next 50 eligible transactions: ₹25

- Next 100 eligible transactions: ₹25

- This initiative encourages the use of digital payment methods among street vendors, promoting financial inclusion and modernization.

Conclusion

The PM SVANidhi scheme has made significant progress in empowering street vendors across India. It aims to provide economic stability to vendors adversely affected by the pandemic by offering collateral-free working capital loans of up to ₹10,000.

The PM SVANidhi scheme encourages digital transactions through cashback incentives and rewards regular loan repayments. The implementation partner, SIDBI, ensures the effective distribution of loans through various lending institutions.

Check Out: Indira Gandhi Smartphone YojanaDigital transactions have received a significant boost, aligning with the government’s push for a cashless economy. Overall, the PM SVANidhi scheme not only promotes self-employment and economic independence. It also contributes to personal financial independence for street vendors.

Frequently Asked Questions (FAQs) about PM SVANidhi Scheme

1. What is the PM SVANidhi Scheme?

The PM SVANidhi Scheme, or Prime Minister Street Vendor’s AtmaNirbhar Nidhi, is a central government initiative launched in June 2020 to provide micro-credit facilities to street vendors affected by the COVID-19 pandemic. It offers collateral-free working capital loans.

2. Who is eligible for the PM SVANidhi Scheme?

Street vendors engaged in urban areas on or before March 24, 2020, who possess a Certificate of Vending/Identity Card issued by Urban Local Bodies (ULBs) or a Letter of Recommendation (LoR) from the ULB/Town Vending Committee (TVC) are eligible.

3. What are the objectives of the PM SVANidhi Scheme?

The scheme aims to:

Provide economic stability to street vendors by offering unsecured working capital loans of up to ₹10,000.

Incentivize regular loan repayments.

Promote digital transactions and reward vendors with cashback for processing payments digitally.

4. How much loan can street vendors get through PM SVANidhi?

Street vendors can avail of unsecured loans of up to ₹10,000.

5. What is the repayment tenure for PM SVANidhi loans?

The beneficiaries can repay the loan amount over a period of 12 months.

6. Is there any benefit for early loan repayment?

Yes, the scheme provides a 7% subsidy on the interest amount if the loan is repaid before the scheduled tenure.

7. Which lending institutions offer PM SVANidhi loans?

PM SVANidhi loans are offered by Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks, Non-Banking Finance Corporations (NBFCs), Micro Finance Institutions (MFIs), and Self-Help Groups (SHGs).

8. How can street vendors apply for PM SVANidhi loans?

Street vendors can apply online by visiting the official PM SVANidhi website, where they need to provide their details, mobile number, and required documents.

9. What documents are required for PM SVANidhi application?

Documents like Aadhaar card, Voter ID card, and vending certificates or LoRs are required for verification.

10. How can street vendors check the status of their PM SVANidhi loan application?

Street vendors can check their loan status by visiting the PM SVANidhi website and using their application number.

1 thought on “PM SVANidhi Scheme: Empowering Street Vendors for Economic Upliftment | How to Apply?, Process Guide”